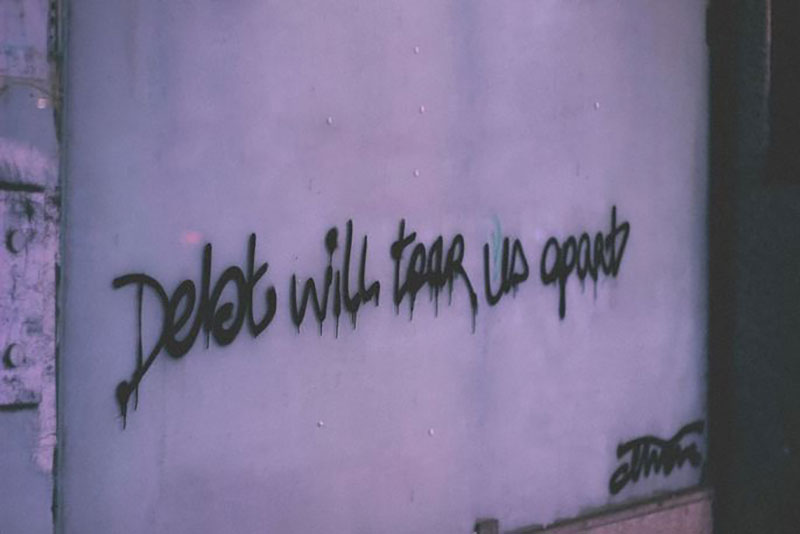

05 Apr Debt Will Tear Us Apart

Australians have some of the highest debt rates in the world, and all too often, many people find themselves in need of some relief from multiple debts. If you’ve found yourself in a situation where multiple debt are adding pressure and strain to your everyday life and relationship, know that there are options available to you that can help make your debt more manageable, reduce your interest payments, and find a long-term solution that will enable you to make substantial progress towards becoming debt-free.

Debt Consolidation

Debt consolidation is a process that reduces multiple loans into one easy-to-manage monthly payment. This can provide a payment plan that’s more effective, as you’re not dealing with multiple creditors from month to month, and instead have only one simple, easy payment to help you get back on track.

An broker skilled in debt consolidation can work with you to find competitive options available to you in terms of consolidating your various debts into one. Whether your debt source is a credit card debt, personal loan, home loan or car loan, a broker who’s skilled in this area will be able to introduce you to a wide range of products available on the market. They’ll also be able to advise you on which debt consolidation option is suitable for your individual financial situation, as this can differ from person to person. Most of all, you want to work with a broker who’s trustworthy, experienced and reliable, motivated by your goals rather than by gaining themselves the highest commission.

Work With An Expert

As there are a number of options available when it comes to debt consolidation, arming yourself with an expert who’s playing on your team is a great way to move forward decisively and with peace of mind. The finance industry is a complicated world, so gaining the wisdom and experience of your broker will empower you in your debt consolidation process.

When examining a debt consolidation offer, you’ll need to compare interest rates, fees and charges to gain a strong overall picture. There’s no point consolidating your debt, only to end up being hit with more fees than you were paying before! There are options to reduce fees payable on debt consolidation loans, such as securing the loan against your home and assets. Again, this is an area where an expert in the field will be able to prove their weight in gold by advising you on how to navigate the complexities of each loan on offer, making sure you complete the debt consolidation process with a workable solution.

If you’re looking to consolidate your debts, or just to get some advice on how to strengthen your overall financial position if multiple debts are a problem, get in touch with our team at Aspirus Financial Services. Our familiarity with the Australia finance industry, as well as our years of experience and integrity, means we we’re positioned to help you move towards financial freedom. We look forward to hearing from you!

No Comments